About 'debt collection forum'|... and business fees, and ending San Diego’s guarantee of free trash collection for owner-occupied single-family homes, would bring in enough money to help...

In June of 2004, my (now) husband was admitted to the hospital when he went to the emergency room with severe abdominal pain. A week later, he was discharged, minus his gall bladder. Over the summer months, my husband received numerous small doctor bills that he had assumed were part of the claim during his hospital stay. He paid the required co-pay on each of these bills and since he had been admitted via the emergency room, had no reason to think that United Healthcare would not cover his surgery or his hospital stay. Under his health insurance plan, any hospital stay and subsequent surgery that came about from an emergency room visit was fully covered, minus any individual doctor co-pays. If he'd visited the doctor previously complaining of abdominal pain, then the claim could have been denied due to their pre-existing condition clause. Since that was not the case, he went about his merry way and didn't think about it again. In November of 2004, a bill arrived from a bill collector. It was for an unpaid hospital bill to the tune of $67,000. This was the first indication that perhaps something had gone wrong with the health insurance claim. My first thought was that the hospital had probably sent out the bill before the health insurance had processed the claim. My husband called United Healthcare to confirm my suspicion, where he was told the claim had been denied, and the health insurance company cited the reason for the denial was due to a pre-existing condition. After being asked several questions surrounding the hospital stay where my husband iterated that he had not ever seen a doctor for abdominal pain, the insurance adjuster seemed satisfied that the error was on their end and said he would request that the claim be reprocessed. The adjuster also said he would send out a questionnaire that asked the same questions he'd just asked my husband. My husband was given a phone number and a claim number should he feel the need to follow up. The promised letter never arrived, we forgot about it, and due to the silence of the health insurance agency, assumed that the matter had been taken care of. Fast forward to October of 2006. A collection notice arrived from a third-party collection agency, offering to settle the $67,000 bill for the mere sum of $23,000. Obviously, something had gone awry again. By now, my husband had moved on to another job and no longer had health insurance with United Healthcare. We had also moved during this time, too. The first thing we did was send a registered letter to the collection agency to dispute the validity of the debt and demand that they send us a copy of the debt owed. I figured this would buy us some time to figure things out before the collection agency demanded a court date. It would also officially put the debt in question into dispute status on my husband's credit report. They sent us a copy of the hospital bill, which was 57 pages long. We found the phone number and claim number and called United Healthcare, only to discover that the phone number given to my husband by the adjuster was no longer in use. I went online and after much digging, managed to find a phone number. I did not find this phone number anywhere on United Healthcare's website; rather I scoured the Internet and found a user forum where a user had posted it. Thus began our sojourn into Health Insurance Claim Hell. I explained the scenario to the first representative, and she seemed very sympathetic and apologized for our troubles. When I gave her the claim number, she discovered the claim number we'd been given so long ago actually was for a different claim, and that one had been paid. Meanwhile, there appeared to be no record on file for his hospital stay. The representative told me there were no outstanding claims, but due to the age of this claim, it most likely had been purged from their electronic system and stored on film. She put in a request to pull the claim from storage; I was told it would take two weeks. Two weeks later, I called again to make sure they had been able to retrieve the claim. Once again, I had to explain all over again what had happened. This representative also seemed nice, and she managed to see the claim that had been pulled from storage. She informed me that the claim had been denied. The reason? It had been a pre-existing condition. I politely asked her if we could request the claim to be reprocessed and explained once again that the hospital stay and surgery was not in any way related to a pre-existing condition. Since he had been admitted through the emergency room, she agreed and told me it would take two weeks to reprocess the claim. I marked the calendar and called again two weeks later. I went through the whole story again to yet a different representative, who merely chuckled and said it would take at least thirty days to reprocess a claim, and that it was too soon to know the results. I marked the calendar and when a month had passed since requesting the reprocess, I called and spoke to another different representative, who told me that the claim could not be processed because they were waiting for us to return some paperwork to them. I asked what paperwork that might be, and the representative said it was a questionnaire we needed to complete and return. I informed the representative that this was the first we had been told of such a letter, so he put in a request to have the questionnaire sent to us. He advised to allow two weeks' time for the questionnaire to arrive. After two more weeks passed, I called to inform United Healthcare that the promised questionnaire did not show up. Once again, I spoke to yet a different representative, and had to retell my story to this person. This representative told me their records showed it had been sent. I asked to verify the address they sent the questionnaire to, and the representative rattled off an address I had never heard of. It wasn't our current address or our previous address. In fact, it had been sent to an apartment. Neither I nor my husband had lived in an apartment while he had health coverage with United Healthcare. When I asked what I had to do in order to update the address, the representative informed me that my husband would have to call his employer and request the address be updated through them. I asked what does he do if he no longer works for that employer and he no longer has health insurance with United Healthcare, this being the case for over a year and a half. The representative insisted this was the only way to update the address they had on file. Realizing that the odds of us actually ever receiving the questionnaire were slim, I asked if she could fax me a copy of it. The representative complied. When I pulled the fax from the fax machine, I could hardly believe my eyes. Here, finally, was our golden ticket, our only means of ever getting to the bottom of this unpaid claim. What I found instead was a single page with a checkbox asking if my husband had any pre-existing conditions, and instructions to fill out the information indicated on the lines below that had an "x" next to it. None of the lines below had an "x" next to them. I called back, parroted the whole story from memory by now, and asked which line I needed to complete. The representative told me she didn't know. She had no way of knowing which line I needed to complete, because she didn't have any way of viewing the questionnaire that had been sent to us. Apparently the previous representative had faxed over a blank questionnaire. Sensing that this was going to end badly, I requested to speak to a supervisor. I was told a supervisor would call me back within 48 hours. When the 48 hour timeframe had come and gone, I decided I was done dealing with United Healthcare. Certainly there had to be an advocate group out there to help people in cases such as this. I discovered that the State Commissioner's Office of Virginia did indeed help people with scenarios similar to ours. This whole time, I had kept notes on who I spoke to, when I spoke to them, what I was promised, and what actually happened. I took my notes and typed them all up in a letter which I sent to the State Commissioner's Office, who then forwarded my letter to United Healthcare. Any correspondence from this point would be mediated by the State Commissioner's Office. Within a week, we had received a reply back from United Healthcare, which had been forwarded to us via the State Commissioner's Office. In their reply, United Healthcare essentially begged that this not go down as a formal complaint against the company, and that they would look into the situation and come to a resolution within 45 days. They promised to send a letter stating their final decision about the claim to the State Commissioner, who would then forward it to us. I finally began feeling a sense of hope. Maybe, just maybe, this would be the answer and soon this nightmare would end. I finally felt like somebody had my back and was listening to me. While we were waiting, we received a doctor bill for a co-payment, which we took as a good sign. Maybe United Healthcare was finally processing the claim and now the doctors were sending out our portion of the bill. We immediately paid the amount owed and waited for the final letter from United Healthcare. But then the 45 days passed without receiving anything. In fact, it's been about 6 months and we still have not heard back from United Healthcare. I know we should elevate this issue to the next level, but I fear we are succumbing to the wear-down tactics of the health insurance company. If they make things difficult enough, people will give up fighting against improperly denied claims. In the meantime, I know that we are not alone. United Healthcare, I discovered, denies more claims than any other health insurance company out there. They deny a whopping 14.4% of their claims, whereas the national average stands at 4%. This experience has completely soured me on health insurance altogether. We faithfully paid our premiums every month, and the one time we needed health insurance, they did not come through. Not only did they not come through, they have fought us the entire way while taking our money, and have ruined my husband's credit. Neither of us currently have health insurance. Rather, I view health insurance the same way I do social security: it's a good idea, but I am not counting on it to be there when I need it. It is every man for himself out there these days. I would rather put the money I would have spent on monthly health insurance premiums into an investment account and put that money to good use so if we need it for health reasons later, we can count on it being there. Sources: "Think You're Insured? Maybe Not." - March 2007 issue of Money Magazine by Walter Updegrave and Kate Ashford |

Image of debt collection forum

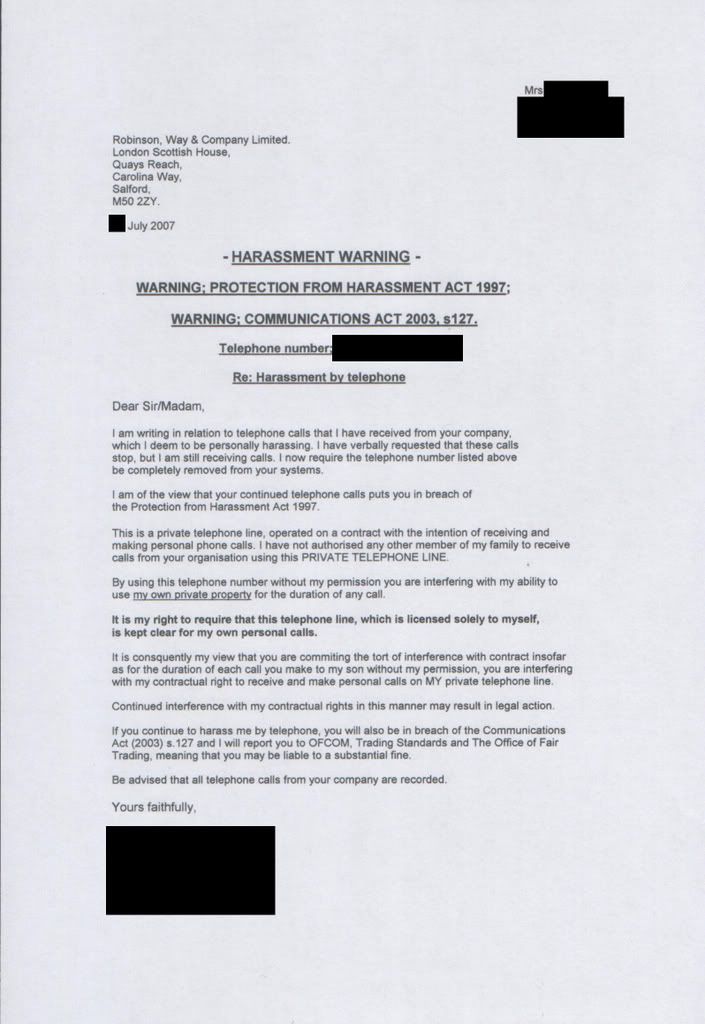

debt collection forum Image 1

debt collection forum Image 2

debt collection forum Image 3

debt collection forum Image 4

debt collection forum Image 5

Related blog with debt collection forum

- unclenormie.blogspot.com/PCMHOLDINGS.COM DEBT COLLECTION FORUM POSTINGS. The PCMHOLDINGS...if you go to the pcmholdings forum which is the hangout of the great...

- pubcit.typepad.com/clpblog/Judith L. Fox of Notre Dame has written How Forum Determines Substance in Judicial Debt Collection, 31 Banking and Financial Services Rev. 11 (August 2012). Here's the abstract...

- whattaboutbob.blogspot.com/... to be worth $7 billion prior to bankruptcy. And it has total debts of around $4 billion. Even assuming the bankruptcy process doesn't get the very best...

- zengersmag.blogspot.com/...argue that it’s the more books, the better; the larger the collection, the better; and all that. But at some point, I really think we’ve got...

- zengersmag.blogspot.com/... and business fees, and ending San Diego’s guarantee of free trash collection for owner-occupied single-family homes, would bring in enough money to help...

- prosperlending.blogspot.com/On the official forums, Prosper has announced a debt sale and an aggressive debt collection pilot program. Debt...his blog ( debt sale , debt collection pilot ).

- serviceofprocesslookingforward.blogspot.com/... to closely monitor debt collection arbitration and evaluate whether creditors and arbitration forums provide consumers with meaningful...

- funwithgovernment.blogspot.com/...), increasing collection efficiency (especially at ...we might now also consider: * Debt conversions of all... them in this Forum. Feel free (anyone) to comment either...

- tuananh108.wordpress.com/... for DSO however there are forums for most industries where membership...project or product. Measuring your collections staff by DSO can create a healthy competitive...

- skiptraceconsultant.wordpress.com/... the Credit and Collections Forum? Here is the link http://....com Things with the Debt Collection Connection are really hopping...

Related Video with debt collection forum

debt collection forum Video 1

debt collection forum Video 2

debt collection forum Video 3

Thanks for the nice blog. It was very useful for me. I'm happy that I found this blog You made some good quality points there. So a lot to occur over your amazing blog. Your blog procures me a fantastic Spiderman No Way Home 2021 Jacket transaction of enjoyable.. Salubrious lot beside the scene

답글삭제